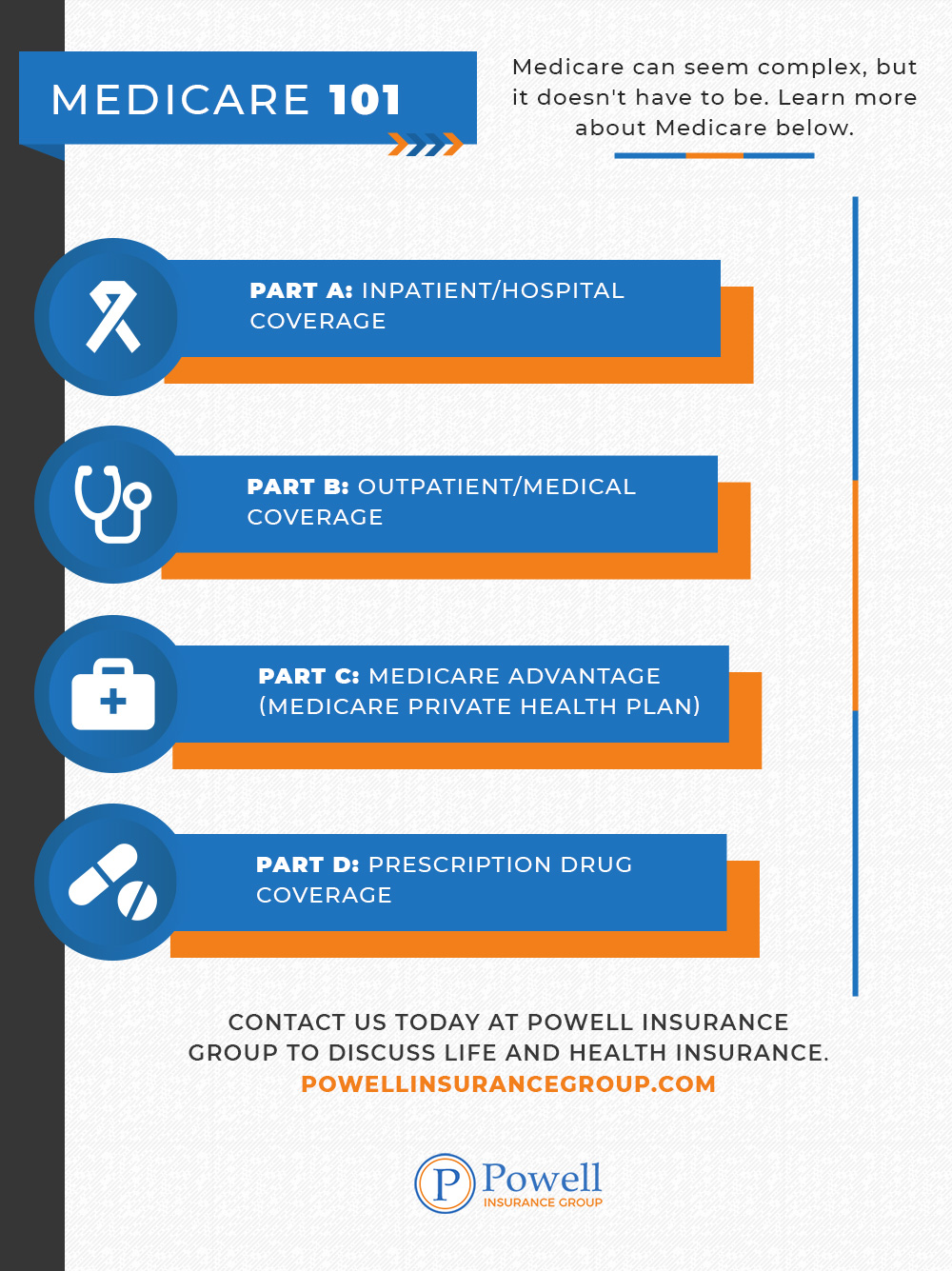

Medicare 101

As a federal health insurance program, Medicare has survived for the past five decades — providing quality medical care to Americans with a few significant modifications over time. Today, this federal program supported countless individuals — including older Americans, people with disabilities, and those who have been diagnosed with end-term renal disease. Like any other coverages, there are typically costs associated with each individual service. Below, we have listed a few of the general rules that describe how medicare works:

Factors that affect Medicare costs:

- Whether or not you have Part A and Part B (most people have both)

- Whether your doctor or health care provider accepts assignment

- The type of healthcare needed and how often it is needed

- Whether or not you choose services or supplies not covered by Medicare

- Whether or not you have another health insurance paired with Medicare

- Whether or not you have Medicaid or help paying for Medicare

- If you have a Medicare Supplement Insurance (Medigap) policy

- If you or your healthcare provider have signed a private contract

- And more!

Medicare Supplement Insurance (Medigap)

Medigap is designed to pay some of the expenses not traditionally covered by Medicare (Parts A and B). Medicare supplement insurance is not designed to replace Medicare and is instead designed with the intent to pay for some of the expenses like copayments, coinsurance, deductibles, and more. Medigap is created and standardized by the same agency that controls and regulates Medicare, but it is designed to be sold and administered by private companies.

Medicare Advantage

Medicare Advantage plans, sometimes known as Part C, are where beneficiaries have the option to have their Medicare paid out through private health plans. Medicare Advantage is designed to cover Medicare Parts A and B, while also sometimes including Part D coverage. Dental benefits and vision coverage can also be included in Medicare Advantage plans.

Medicare Part D (Prescription Drug Plans)

Last, but certainly not least, is Medicare Part D — a supplemental Medicare plan to supplement Parts A and B. Part D coverage adds prescription drug coverage to Original Medicare and Medicare Advantage plans. These plans are often offered by private companies and are written to follow guidelines put in place by The Centers for Medicare and Medicaid Services.